DOWNLOAD NEPAL BUDGET 2079/80 NEPALI in PDF

DOWNLOAD NEPAL BUDGET 2079/80 NEPALI in PDF

Budget 2079/80 Highlights:

The minister of Finance, Janardan Sharma announced the Budget of Nepal for Fiscal Year 2079/80 after approval of the cabinet meeting in the joint sitting of the federal parliament.

Budget Goals: Stability, productivity, and employment growth.

The major purpose of the budget is to decrease imports by 20% and increase export by double.

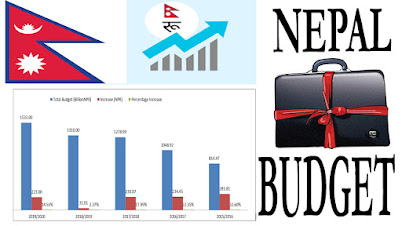

Budget Size: 17.93 Kharba,

Re-Current Expenditure- 7.53 Kharba

Capital Expenditure- 3.80 Kharba (21.2%)

Financial Management- 2.30 Kharba (12.8%)

Financial Handover to Province/Local Government - 4.29 Kharba (24%)

Sources to attain the required amount to meet the budget size;

- Through Tax - 12.40 Kharba

- Through Grants -55.46 arba

- Through Foreign Loans - 2.42 Kharba

- Through Internal Loan - 2.56 Kharba

Allocation of Budgets:

- Tourism Sector: Rs. 9.38 Arba

- Ministry of Agriculture and Livestock Development: Rs 55.97 Arba

- Industrial Infrastructure: Rs 3.89 Arba

- Ministry of Industry, Commerce and Supplies: Rs 10.48 Arba

- Prime Minister's Employment Program: Rs 7.5 Arba

- Health Insurance Program: Rs 7.5 Arba

- Ministry of Health and Population: Rs 69.38 Arba

- Rs. 2 Kharba to state and Rs. 40 Arba to the Local level

- Per capita income of Nepalis increased by Rs 18,000.

- Establishment of business incubation centers: Rs. 26 Crores.

- Rs.6.53 Arba budget allocation for railway construction.

- Rs.2.46 Arba to the Ministry of Youth and Sports.

- Rs.13 Arba allocation in forest and environment sector.

- Rs. 6.70 Arba allocated for postal highway.

- Continuity of constituency strategic road; Rs. 7 Arba.

- Rs. 70.05 Arba for Education Sector.

- Rs. 1.42 Arba for the construction of all local level administrative buildings within two years

Health Sector:

- Rs 6 Arba has been allocated for health in the states and Rs 27 Arba at the local level.

- Free health check-up once a year for people over 40 age.

- Rs 200 million has been allocated for installing dialysis machines at each provincial hospitals.

Tourism/COVID Relief and related Sectors:

- 10 lakh tourists to be attracted next FY

- Hotel businesses affected by COVID-19 will get an exemption of license and renewal fees.

Agriculture Sector:

- The government has introduced Kisan Pension Scheme. The government will deposit 10 percent of the amount deposited by the farmers in this scheme.

- Imports of paddy, maize, wheat, and vegetables will be reduced by 30 percent.

- Rs 45 Crores was allocated for 100 food warehouses across the country.

- A microfinance fund will be established to disburse loans equal to Rs. 5 Kharba to provide agricultural loans at home.

- 80 percent premium of agricultural insurance will be borne by the government.

Government Policies in Business Sector:

- Only entities and individuals who have obtained permission from the official body will be allowed to trade real estate.

- Up to 8 percent cash subsidy on cement, steel, footwear and treated water exports

- Cooperatives should invest 50 percent in the productive sector.

- The government is going to open the way for Nepali construction businessmen to serve abroad.

- Loan is available on project collateral to manage capital from Venture Capital.

- Government land leased for 50 years for setting up industries

- To encourage the operation of sick industries in the private sector.

- Cement and Other export-oriented industries to be benefitted

- Seed capital will be provided through venture capital to support the startup business.

- The interest rate of productive sector and business loan will be different.

- Each branch of commercial banks will have to provide loan to at least 5 agricultural production and processing industries.

- Government announces to operate Hetauda textile industry.

- Local infrastructure department dismissed.

- Green Hydrogen and Green ammonia-based fertilizers factory will be established in the collaboration with Investment Board.

- Government to build 13 big hydropower

Salaries:

- Salaries of government employees increased by 15 percent.

- Salary of employees of different levels has been increased from at least Rs. 3520 to Rs. 10260.

- Salary of teachers, army and police will also increase. This will also increase the income of pensioners.

- The increased salary will be applicable for civil servants as well as police, army, teachers, and professors.

- The salary of the second tier has increased by about Rs 3700 to Rs 28,355.

- The salary of the third tier employees has also increased by around Rs. 3900 to close to Rs. 30,000.

- The current monthly salary of the fourth level employees has been increased by about Rs. 4200 and that of the fifth level employees by about Rs. 4600.

- The salary of Gazette Anankit employees has been increased from a minimum of Rs 4560 to a maximum of Rs 4920.

- The monthly salary of government employees has risen from at least Rs 26,990 to Rs 78,667. Apart from this, they will also get an additional monthly allowance of Rs 2000.

- The monthly salary of the secretary will reach Rs 56,582 while the monthly salary of the special secretary will be Rs 66,652. Similarly, the Chief Secretary has reached Rs 70,406.

- Employment will be increased by 30 percent annually.

Others:

- Newa Museum will be established in Kathmandu.

- The government has lowered the minimum limit for foreign investment to Rs 2 Crore. At present, the limit is Rs 5 Crores.

- Arrangements to sell apartments to foreigners

- Self-employed citizens will be included in the citizen pension scheme.

- Old age allowance in 68 years now. Previously, it was 70 years.

- One electric stove per family will be distributed at the local level.

- Minimum is FDI Rs 2 crore

- Government offices are encouraged to use domestic produced goods

- To provide barren land on lease

- Private equity and venture capital will be allowed to operate.

- Rs 500,000 minimum income tax slab for unmarried people.

- Rs 600,000 minimum income tax slab for married people.

- The limit of discounted insurance premium is Rs.40,000 from present Rs 25,000.

- The previous monthly allowance of Rs 2,000 has been continued.

- The government has made arrangements for free kidney transplants.

- Concessional loans to returnees from foreign employment.

- LPG subsidy will be removed, the price of cooking gas will increase.

- Provision of safe housing for the extremely poor, dalit and endangered castes.

- Now also public welfare advertisements to online media.

- Reduced internet service charges.

- Announcement to develop Marin of Sindhuli as a new city.

- Entrepreneurial housewife program will be conducted.

- The economic growth rate will be 5.8 percent.

- Petroleum pipeline from Siliguri in India to Jhapa will be made soon.

- Inflation target for next year is set to be below 7%

- National Cyber Security Center will be established to ensure cyber security among the citizens and digital forensic research of digital systems of governmental units.

Education Sector:

- Announcement to start technical education in 12 hundred schools across the country.

- Rs 8.3 Arba has been allocated for Technical and Vocation Education programs.

- The loans for startups and young entrepreneurs on the collateral of their educational certificate have been continued

- Rs 10 crores has been allocated for the procurement of internet and digital boards in 20 schools in all provinces.

Financial Sectors:

- Concessional loans will be provided through microfinance.

- 5 Kharba microfinance fund, farmer pension program will be started to give loans to farmers through microfinance.

- Insurance companies must invest a certain percentage of their profits in the infrastructure sector.

- Hedge funds will be established to reduce the risk of forex rate fluctuations in the international investments

- All the payment collections and payouts from three levels of the government will be made through the banking channel

- Required provisions will be made to develop fully digitized banking services

- The online trading system of the securities market (NEPSE) will be improved

- Legal provisions will be made to allow NRNs to invest and trade in the secondary capital market

- 10% share quota for IPOs to be allocated for the Nepali investors living abroad.

- Companies with capital more than Rs. 1 Arba must issue IPO

- Companies that does transactions of more than Rs. 5 Arba must issue IPO.

- Companies that uses natural resources and enjoys government benefits are to issue IPO.

Electricity Sector:

- 2 to 15 percent concession to industries consuming Rs 10 crores electricity monthly.

- IPO of Nepal Electricity Authority granted at a premium price. To invest the collected amount in the project containing the reservoir.

- Electricity will be considered the major exporting product for improving international trade and decreasing the trade deficit.

- People who consume less than 20 Units of electricity should not pay the price of electricity.

Youth and Sports:

- The construction of Mulpani cricket stadium to be over this year.

- Kirtipur stadium to be upgraded to host night time events.

- Gautam Buddha International Cricket Stadium to be taken over by the government.

- Lifelong monthly life insurance for Asian and Olympic medalists.

Railways, Airways and Roadways:

- Dadeldhura Balewa Dang and Tikapur airports will be upgraded.

- Arrangements will be made for electronic payment in transportation in major cities.

- Government announces to build three expressways connecting Chitwan with Kathmandu, Butwal and Pokhara.

- Supreme Court has to allocate budget for the construction of Nijgadh International Airport.

- Announcement to expand Narayanghat road section.

- The government has given priority to roads connecting China.

- Accelerate the construction of East-West Railway Bardibas - Nijgadh section.

- Rs. 5 Arba to Nagdhunga tunnel.

- Rs. 9.33 Arba budget for Pushpalal Highway.

- Rs 1 Arba budget for the expansion of the ring road.

- Rs 12.24 Arba has been allocated for the improvement of airways infrastructure in Nepal.

- Utility Corridors will be developed to remove the repetition of maintenance works on the roads and urban settlements and the inconvenience caused by them.

- Unbundling of the Civil Aviation Authority of Nepal into two bodies.

Tax rebate:

- Only one percent tax will be levied on singles up to Rs 500,000 and up to Rs 600,000 on couples. Earlier, it was Rs 4 lakh for singles and Rs 4.5 lakh for couples.

- The limit of tax exemption from insurance premium has also been increased. The limit of Rs.20,000 has been increased to Rs. 40,000.

- Electrical vehicle assembling factory to get 40% tax deduction for 5 years.

- nepal budget 2079 80 pdf

- nepal budget 2079 80 pdf download

- budget of nepal 2079 80 pdf in nepali

- budget of nepal 2079 80 pdf download

- budget of nepal 2079 80 in nepali

- budget of nepal 207879 pdf in nepali

- budget 2079 80 pdf in nepali

- total budget of nepal 2079 80 pdf

- budget of nepal 2079 80 highlights

- budget of nepal 207879 by janardan sharma

- budget of nepal 2078/79

- budget pdf download free